SAVE WITH SECTION 179 TAX DEDUCTIONS

put federal tax deductions and credits to work for you.

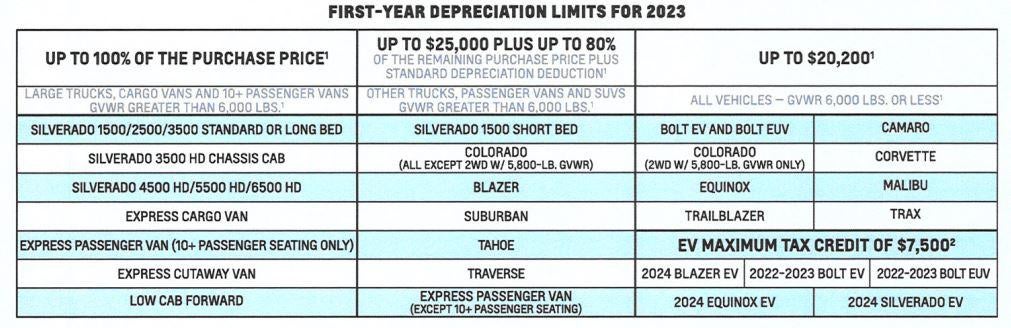

Immediately write off up to 100% of the purchase price of eligible Chevy vehicles.† For 100 years, Chevy has helped business owners do what it takes to get the job done. Now, under new tax depreciation laws, your business may be eligible to immediately deduct up to 100% of the purchase price of an unlimited number of qualifying Chevy vehicles purchased in 2023 for business use.

Deduct up to 100% of purchase price for eligible chevy vehicles.

Take Advantage Today!

With the significant tax savings Section 179 offers, and the end-of-year sales happening now, it is an incredible time to buy.

* NOTE: The information supplied here is provided by Jack McNerney Chevrolet as a public service to its customers. It should not be construed as tax advice or as a promise of potential tax savings or reduced tax liability. Individual tax situations may vary. Federal rules and tax guidelines are subject to change. For more information about the Section 179 expense write-off or other business vehicle expense write-offs, you should consult your tax advisor for complete rules applicable to your transaction and visit the Internal Revenue Website at www.irs.gov.1 Federal tax benefits are available for vehicles acquired for use in the active conduct of trade or business and may change or be eliminated at any time without notice. Each taxpayer’s tax situation is unique; therefore, please consult your tax professional to confirm available vehicle depreciation deductions and tax benefits. For more information, visit irs.gov. This advertisement is for informational purposes only, and should not be construed as tax advice or as a promise of availability or amount of any potential tax benefit or reduced tax liability.

Jack McNerney Chevrolet

363 Rte 281, po box 1054, Tully, NY 13159

Contact UsHours

| Monday | 8:30AM - 7:00PM |

| Tuesday | 8:30AM - 7:00PM |

| Wednesday | 8:30AM - 7:00PM |

| Thursday | 8:30AM - 7:00PM |

| Friday | 8:30AM - 6:00PM |

| Saturday | 9:00AM - 3:00PM |

| Sunday | Closed |

| Monday | 8:00AM - 5:00PM |

| Tuesday | 8:00AM - 8:00PM |

| Wednesday | 8:00AM - 5:00PM |

| Thursday | 8:00AM - 5:00PM |

| Friday | 8:00AM - 5:00PM |

| Saturday | Closed |

| Sunday | Closed |

| Monday | 8:00AM - 5:00PM |

| Tuesday | 8:00AM - 8:00PM |

| Wednesday | 8:00AM - 5:00PM |

| Thursday | 8:00AM - 5:00PM |

| Friday | 8:00AM - 5:00PM |

| Saturday | Closed |

| Sunday | Closed |